Danish pellet-fired power and heat generation typically peaks during the heating season, which can at times extend to April-May. Utilities have an obligation to generate heat at district heating units, for which they receive state support. But power generating units do not receive any support during the summer, and are incentivised to burn pellets only when power prices are sufficiently high to generate positive profit margins, as in summer 2021.

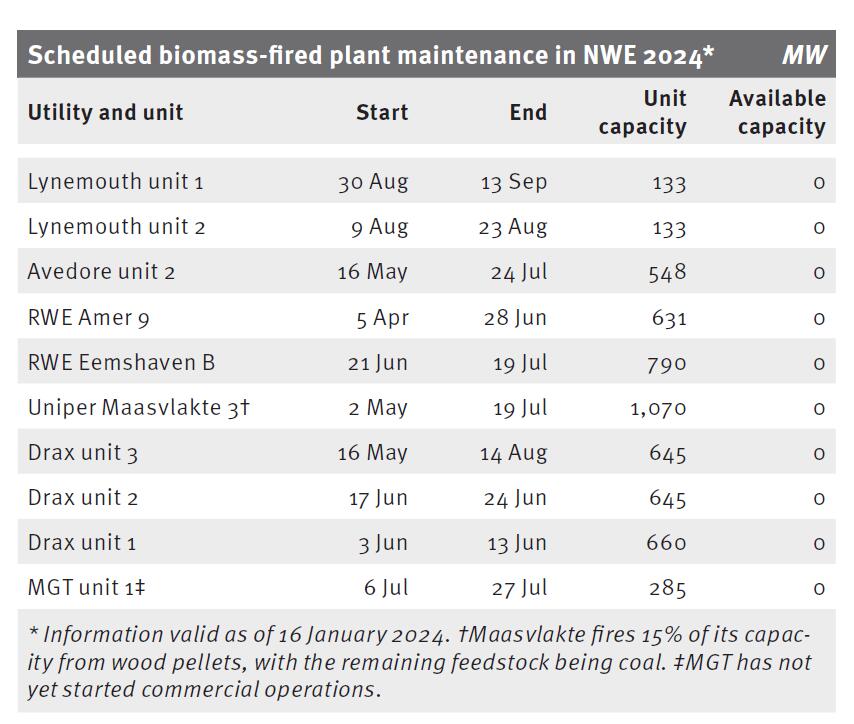

Maintenance shutdowns may also pare pellet use. Orsted’s 548MW Avedore 2 pellet fired unit is scheduled to be taken off line for around two months from mid-May, Remit data show.

As capacity ramps up, long-term supply contracts for North American and southeast Asian pellets will kick in. This in turn means consumers in Europe and Asia-Pacific may have to compete for North American supplies, particularly during high-demand periods.

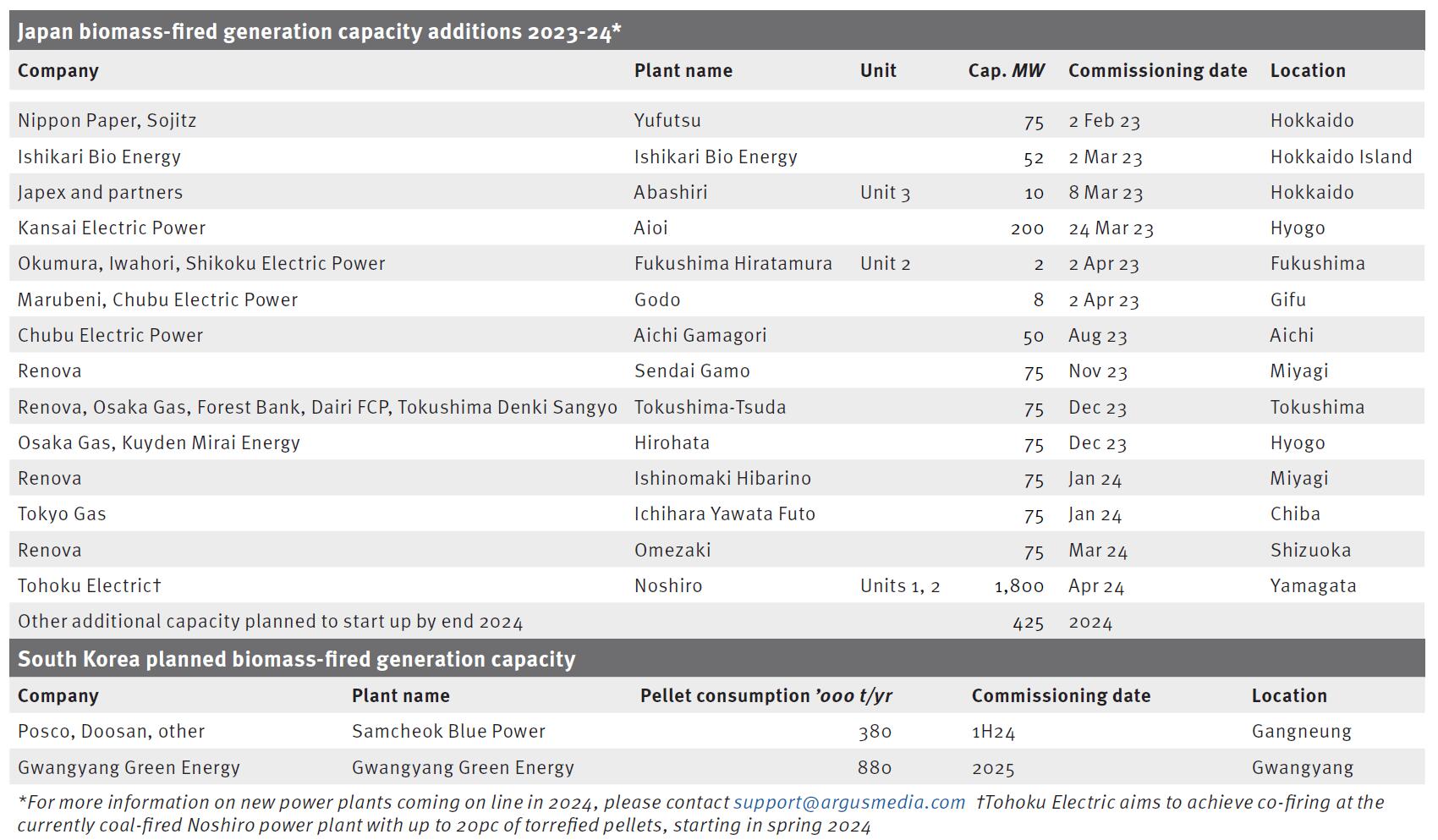

In South Korea, the Samcheok Blue Power plant is expected to start up in the first half of 2024, followed by the Gwangyang Green Energy facility in 2025, with anticipated wood pellet consumption of 380,000 t/yr and 880,000 t/yr, respectively.